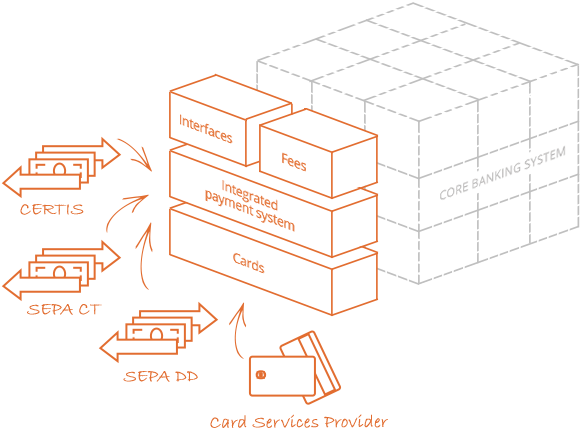

my|BOS Cards

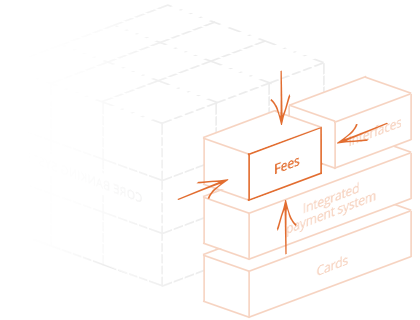

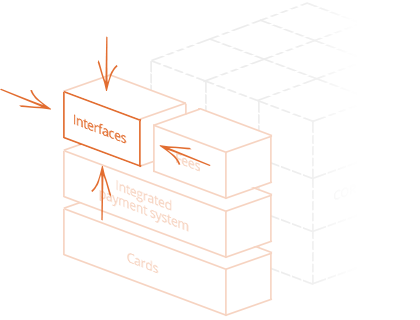

Product for administration of debit cards (Cards), representing a sophisticated interface among banking systems and a provider of (services, transactions) for payment cards. The product can be implemented as fully independent and autonomous, therefore data can be administrated through interactive system functionality, or interfaces for different systems are established and they are primary for this administration. For example clients of direct banking control the cards for their accounts in these systems (card applications, card activation, setting limits, card blocking and others) and only some of the services are done by bank employees (card blocking because of debt collection execution on the account and so on). The product covers the whole cycle of the administration of cards – support for issuing cards, receiving and processing of authorization inquiry (it includes technological as well as functional H2H solutions), receiving and processing of card transactions. There is, of course, the management of complementary services, administration and fee generation for transactions as well as for operation of the cards, complementary services and for events-limit changes, searching and monitoring on-line of authorization inquiries (suspicious and risky payments, generation of statements, extracts for DWH, sending SMS about authorization inquiries and so on.